An efficient document management system is vital to a credit union’s bottom line thanks to low costs, time-savings for members, and improved efficiency.

You can reap these benefits, and more, from a software that your teams likely use everyday – your financial institution’s intranet.

Intranets and document management software have been firm friends since the first intranet portal arrived several decades ago. Over time, as technology and businesses have evolved, so too have document management solutions. And far from just providing an online file repository, document management for credit unions offer tangible benefits that will positively impact your teams’ bottom line. Let’s look into these benefits in more detail below:

Top 3 benefits of your credit union’s document management system

Cost-cutting

Both banks and credit unions use a huge amount of paper documents, which results in steep costs for the materials and storage space (and does nothing for your sustainability credentials!).

Credit unions may have hundreds, thousands, or even millions of members, so having to handle membership and loan applications via paper forms is a substantial burden. The filing cabinet budget alone would be astronomical. Add to that the complexities of changes to processing regulations, and you’re looking at an expensive and complicated setup for managing your credit union documents.

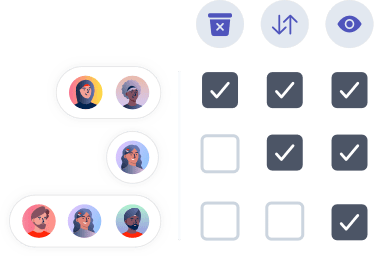

Instead, use your intranet’s document management system to electronically file away your paperwork. Here, you can organise documents and give access rights so that only the approved members of staff can view or download documents. Not only is this more cost-effective, it’s also a much safer way of storing paperwork. By implementing security access rights you’re reducing the risk of electronic documents falling into the wrong hands.

Use your document management system to give access rights to specific team members

Already, this key change completely eliminates the need for managing physical paperwork and slashes the costs for procurement, handling, and storage.

Time-savings

It takes time to complete paperwork. Mistakes can be easily made. And documents can get misplaced or thrown away.

Providing your members and credit union staff the ability to complete applications online minimises these risks greatly, and provides the added bonus of convenience. Application forms can be started and saved for a later date; reviewed and edited by either the credit union employee or member; processed automatically and sent to the appropriate team; and audited after completion to gain valuable insights and trends.

A seamless and engaging customer service experience is key to the credit union member journey. By providing them with an intuitive and simple application process, you’re showing your members the high level of service they can expect by being a part of your community.

Improved efficiency

Handling applications and loans can be complex when multiple team members need to be involved for reviews and approvals. Rather than struggle with the status quo, use your intranet’s document management system and e-forms and workflows tools to make these business processes more efficient and less prone to human error.

By combining the power of e-forms and workflows software – which streamlines repetitive tasks through automated workflows – with your document management system, you can speed up processing time by automatically assigning tasks to the best-suited team member. This is a much quicker and more efficient way of handling paperwork than passing forms around from desk to desk.

Digitising and automating applications online also allows your credit union staff to prioritise submissions based on level of urgency, as the software comes ready with built-in Service Level Agreement (SLA) timers. These act as automatic reminders which notify staff if they are about to breach their processing targets.

In summary

Ultimately, a credit union document management system will help you streamline your processes, drive down costs by removing the need to handle paperwork manually, and save your credit union teams’ and members’ time by allowing them to submit applications online. As a result, staff are able to work more efficiently and provide a more professional service to your valuable members.