“It’s when things get really bad that small wins become especially vital,” states Fast Company co-founder Bill Taylor in a recent article for Harvard Business Review. This seems particularly apt right now given that we’re in the midst of a global pandemic. Small, tangible wins are more important than ever, providing us with a sense of achievement and progress at a time when everything seems uncertain.

Small wins can be deceptively modest too, having a bigger impact than you may expect. Take, for example, the local coffee shops that have switched to takeaways only during lockdown, or the nearby restaurants that deliver meals by bike rather than car. On the surface, these are small changes, but the impact is much bigger – coffee shops can remain open throughout lockdown by adapting how they serve customers, and restaurants can reduce their carbon footprint by taking cars off the road.

Why you need small but mighty wins for your financial processes

The same can be said for making small, incremental changes to your organisation’s internal financial processes. Adjustments that can help your staff avoid the office, work remotely with ease, and stay productive, are all worthwhile improvements that will help you now and beyond.

Swapping common paper-based finance processes for e-forms and automated workflows is a small but mighty win. Even in the best of times, automation makes your employees’ lives much easier, freeing them from manual tasks to focus on more creative and strategic work. But right now, automation can mean the difference between a team member processing invoices quickly from home or having to risk the commute to the office to rifle through filing cabinets.

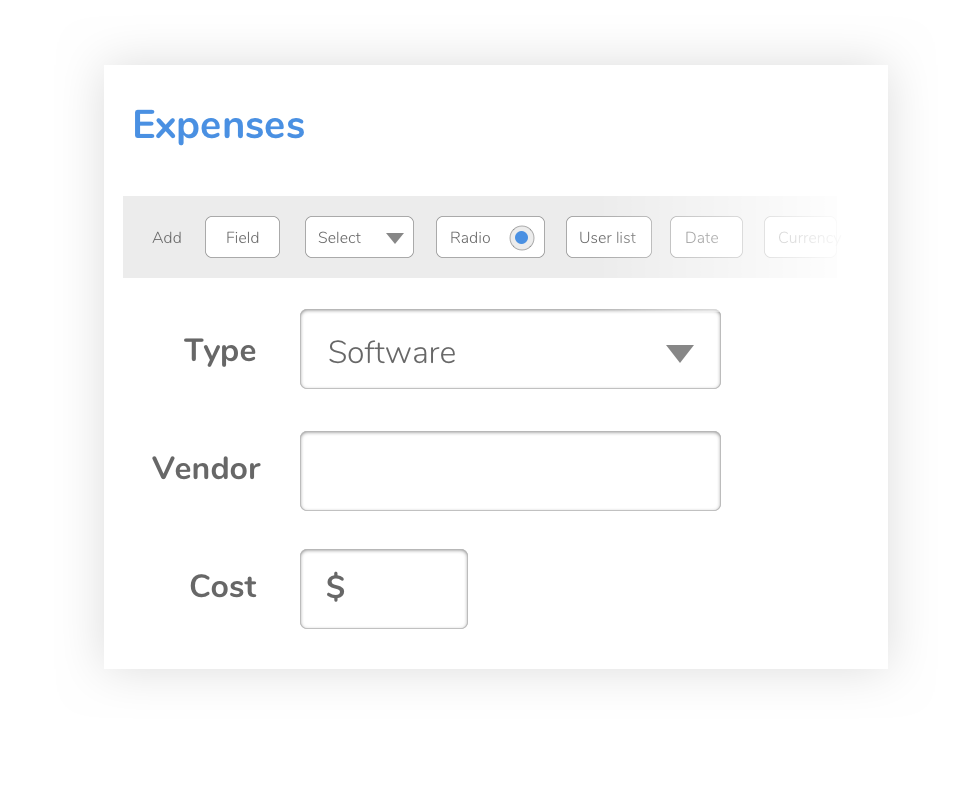

Save your employees’ time by transforming paper-based processes into automated e-forms

Automating just a handful of your financial process can have a long-lasting domino effect that will positively impact your internal SLAs, make your staff more efficient, and enable them to work remotely.

Here are 3 financial processes your business could automate today that will make all the difference:

Purchase order requests

Businesses with a procurement process require their staff to submit purchase order requests whenever they need to buy something for their team. This process is typically quite slow, as it needs to reach multiple departments before final approval by senior management.

Speed up the process and improve your internal SLAs by creating a purchase order request workflow, where you can set up smart features that automatically assign the request to the relevant team members. Staff will get notified whenever they need to action something, making the turnaround process much quicker.

Travel expenses

Travelling for work may be low on the agenda right now, but that doesn’t mean you shouldn’t make it easier for those who still need to venture outside, such as key workers.

Create a travel expenses workflow so that staff can quickly and easily claim back their costs. As soon as a claim is submitted, this will automatically ping a notification to your finance team for speedy processing. Staff will also receive updates whenever their claim progresses, saving them time from chasing via email.

Make it easier for staff to claim back travel expenses with easy-to-use workflows

Invoices

Build a centralised billing system that gives staff the autonomy to submit invoice requests to your finance team. Once a request is submitted, your team can raise invoices digitally, with no paperwork needed.

By keeping all invoicing data in one place, staff can revisit historic invoice information without having to request it directly from your finance team, saving time and manual effort for everyone involved.