High levels of credit union member engagement should be at the top of every credit union leader’s list. But how do you achieve this and why is it so important?

The answer lies in the link between member engagement and employee engagement.

How to increase membership engagement by improving employee engagement

The CIPD reports that there’s a significant link between an engaged workforce and an increase in business performance and productivity. This is hardly surprising, but what is interesting is that internal employee engagement also has a positive impact on customer service and satisfaction – which will ultimately lead to increased credit union member engagement.

Why is this?

In finding the answer, it’s useful to put yourself in the shoes of your potential credit union members and think about the level of service you would expect.

The scenario: imagine you are in the market for a credit union membership, and you have two unions that you’re eligible to join.

- You approach credit union #1, and speak to a member of staff who sounds bored and provides minimal answers to your questions. The exchange ends quickly.

- You then approach credit union #2, and are welcomed enthusiastically by an employee who not only fully answers your queries, but also spends time with you to ensure you understand how the membership process works and that you’re happy with the terms and conditions.

Now, which credit union would you join? It would undoubtedly be credit union #2!

The fact is, if your employees are engaged and happy at work, this will have a huge influence on how your potential members will feel about your credit union, and inform their buying decision.

It’d be easy to point fingers and accuse the employee from the first credit union of simply being terrible at their job. This could be the case, but equally it could go much deeper than that. The same report from CIPD shows that a disengaged workforce poses many business risks, including fostering a culture of employees who are so unmotivated that they do not use their skills and knowledge for the good of the company. In other words, their disengagement affects how they do their job and negatively impacts credit union member engagement. This is certainly a sorry state of affairs, and it’s therefore crucial that employee engagement is top priority in your credit union.

What comes first – employee engagement or credit union member engagement?

Blake Wise, Senior HR & Training Specialist for Belco Community CU and contributor for the Credit Union Times, explained that their own successful member service was actually the driving force behind wanting to improve employee engagement. By applying the same level of service they provide their members to their staff, they were able to boost employee engagement by 5 points in only one year.

So rather than being a one-way street that leads from employee engagement to good member service, it seems the two actually feed into each other to create a positive cycle where they both mutually benefit. One cannot exist without the other.

However, change needs to start somewhere. It’s no use getting into a “chicken and egg” style debate; the key takeaway is that both are crucial to each other’s success. To look at it another way – it’s likely that credit union #2 from the scenario above would get more members, because the positive boost of gaining one member that day would feed back into raising engagement levels, which would then raise member service and acquisition, and so on.

How to increase employee satisfaction and measure engagement

How you improve employee engagement will generally depend on the individual team member and how long they’ve been at the company. However, as a general rule, employee engagement can be boosted via regular constructive feedback, opportunities for professional development, and learning, and a thriving company culture.

But how do you actually implement these initiatives?

Additionally, employee engagement is one of those things that’s quite difficult to measure without any hard data, so you can never be sure if something is working.

So where do you start?

A credit union intranet is a great way of managing engagement initiatives and measuring if they have been successful. Because both the initiatives and the data are captured within the same system automatically, the software can be a one-stop-shop for assessing the returns on improving employee engagement.

One simple example is posting key regulation changes on the intranet, and measuring how many team members read them. If that number is high, it indicates that you have an engaged and on-the-ball workforce who take credit union matters, and its effects on members, seriously.

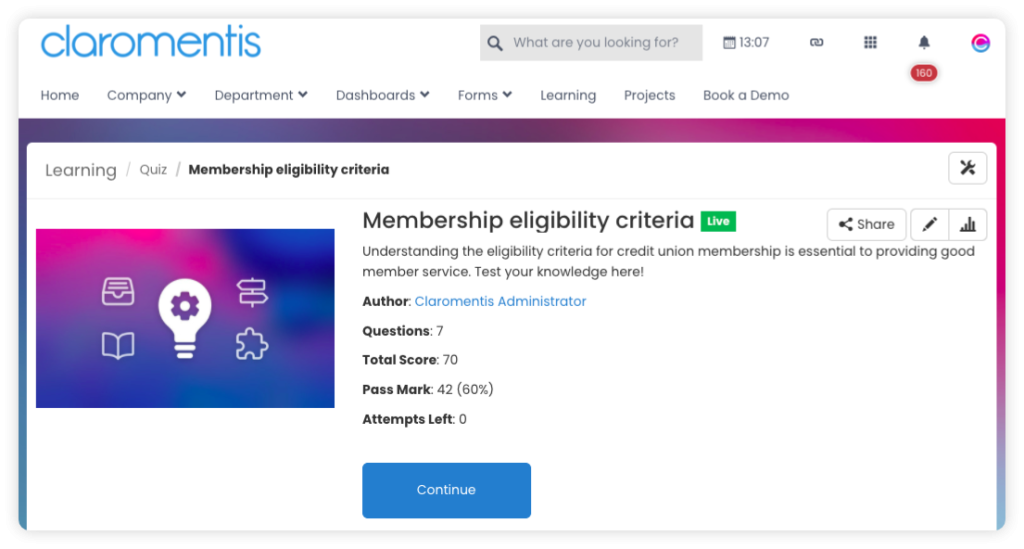

You could go one step further too, by including a link to a quiz that tests the knowledge of staff who have read the article. This is a sure-fire way of measuring genuine engagement with credit union content, as you will be able to monitor who was paying attention, and who may need some additional training.

Quiz your staff using your credit union intranet

Training, one of the key drivers of employee engagement, can also be managed using your credit union intranet’s e-learning system. From here, your staff can take part in online courses to improve their knowledge, gain new skills, and earn accreditations towards a larger learning plan. The e-learning software will capture valuable data such as pass rates and course attendance, allowing you to uncover key insights.

You credit union culture can be digitized as well, with features such as corporate social networking, discussion areas, and instant-messaging readily available in company intranet software. These tools, rather than replacing face-to-face interactions, complement and enhance your culture by providing an online space for discussion. Again, this data is stored on the system, making it easy to analyse engagement levels.

But how does this tie into improving member service? Again, this can be determined using that data recorded in your intranet.

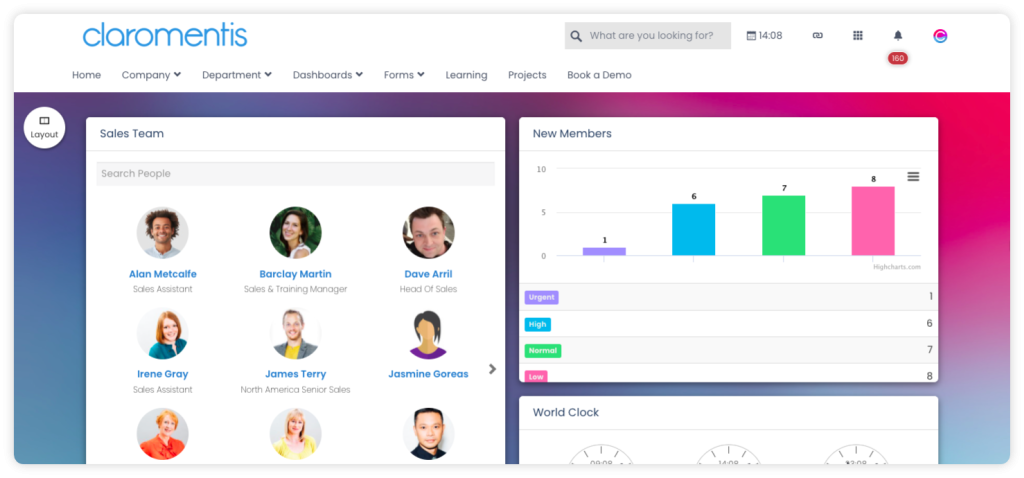

KPIs such as new members gained that month, member retention, and prospective member enquiries can all be recorded and measured within the same intranet system. This data can be cross-referenced with the data revealed from your employee engagement initiatives, allowing you to analyze trends, spot patterns, and detect any areas of improvement. Interactive dashboards can also be displayed on the intranet homepage, providing the appropriate credit union staff with an easy to read, graphical representation of this crucial data.

Display credit union KPIs in your Claromentis intranet

Summary

Using an intranet allows you to not only implement employee engagement initiatives, but most importantly measure their success. Combining this with KPI data such as member retention provides your credit union with a powerful system for improving engagement and member service, which is fully backed by hard data.

![[FREE GUIDE] How to Boost Employee Engagement Across Your Business](https://no-cache.hubspot.com/cta/default/5025095/5694e0cd-c681-4bb5-8551-e3868ed9f392.png)